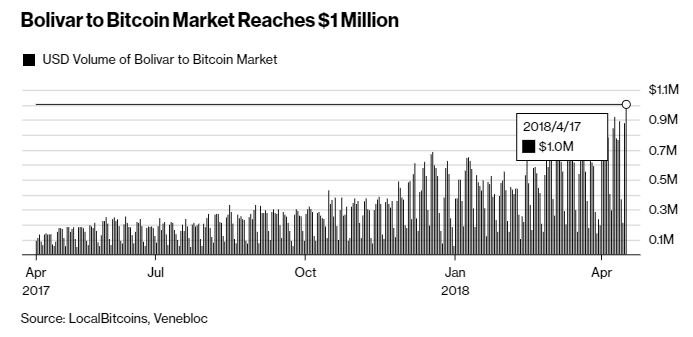

Bitcoin trading volume has achieved an innovative record in Venezuela, surpassing $1 million in one day as locals utilize cryptocurrency for relief from the hyper-inflated bolivar.

Citing data from peer-to-peer (P2P) trading platform LocalBitcoins, Bloomberg reports that bolivar-to-bitcoin trades made up $1.006 million in volume on Monday, marking at first chance that this trading pair has eclipsed the seven-figure barrier in a 24-hour period.

The country’s economic woes were well-documented, and they have been underpinned by runaway inflation that’s seen prices rise by nearly 8,900 percent within the past calendar year.

The government not issues official inflation figures, so platforms like LocalBitcoins, which allow users to prep trades automatically terms, provide efficient price discovery for any bolivar, whose value rapidly declines regularly.

After obtaining bitcoin, Venezuelans often trade it for USD, your primary currency with the country’s black market. Others have to keeping many of their liquid assets in bitcoin, trading it for bolivars when they need to buy something.

Venezuela’s government has turned to cryptocurrency as a resolution to its economic ills as well, creating a state-backed cryptocurrency referred to as “petro” that is allegedly backed by barrels of oil from the country’s crude reserves.

The government says that the petro gets legal tender for all those government transactions this several months, forcing government agencies to accept payments made with the token, which relies on a NEM blockchain.

President Nicolas Maduro claims the fact that initial coin offering (ICO) for the petro, which began in January,? has raised greater than $5 billion, a figure that would be an archive for cryptocurrency token sales. However, most independent analysts — as well as the country’s opposition party-controlled legislature — dispute its accuracy, and there’s a currently no evidence that your petro has raised any money at all.